Competitive Edge

January 25th, 2023

UPDATE: Union Pacific Railroad Halts All Movement of Container Traffic Between LA and the Midwest

All domestic and international containers – in both directions – between Southern California and the key inlands hubs of Chicago and Kansas City have been halted due to a bridge outage on its network in New Mexico.

Read more about this in our freight news section below.

UPDATE: U.S. and Canada Ports – Number of Cargo Vessels at Anchor

• Vancouver: 44 Vessels at Anchor (+1)

• Savannah: 5 Vessels at Anchor (-2)

• Houston: 8 Vessels at Anchor (-6)

• San Francisco/Oakland: 9 Vessels at Anchor (+3)

• Los Angeles/Long Beach: 12 Vessels at Anchor (+5)

• New York/Newark: 3 Vessels at Anchor (-3)

• Charleston: 1 Vessels at Anchor (0)

Note: Count taken on January 24, 2023. This count does not include vessels moored and being unloaded at port docks. Colored numbers in parentheses represents the change from last week over. Data is courtesy of MarineTraffic’s live vessel traffic map.

Have another U.S. or Canadian port you’d like us to track weekly? Let us know!

Takeaways

• U.S. West Coast: Congestion is minimal, but so are freight volumes. While there is low demand moving through all US coasts, the WC has been at the forefront. The WC’s import share continues to deteriorate as labor contract negotiations stall.

• U.S. Gulf Coast: In ways of marine traffic, Houston continues to see some attention. Any volumes moving in are typically still being diverted from WC destinations to GC and EC counterparts. Ironically, Houston has a dwell fee set to be implemented next month, while Los Angeles and Long Beach have long phased their similar programs out. Maybe, this will change shippers’ minds of WC routings if Houston’s fee is imposed.

• U.S. East Coast: No significant changes from last week. Consistency is key, and if we learned one thing this past year, it was certainly lacking on the EC and its up-and-down congestion just a few months ago. However, now it appears the EC is consistent in minimal vessel congestion.

• Canada: Vancouver remains obscenely congested. Internal issues continue to hamper Canada’s largest port. Wait times are in and around seven days.

IMPORT: Asia to North America (TPEB)

Recent Developments:

• Chinese New Year began January 22. Ports will return to normal operations and factories will reopen February 5.

• West Coast contract negotiations between the International Longshore and Warehouse Union (ILWU) and Pacific Maritime Association (PMA) remain active. The existing labor contract between the two parties expired July 1.

Rates: Rates to the WC leveled before CNY. EC and GC rates are still seeing decreases.

Space: Space is open.

Capacity: Capacity is open. However, blank sailings are now typical as a means from carriers to shed this excess market capacity and restore scheduling. That said, we cannot rule out a possible capacity crunch as a bulk of CNY blank sailings are expected over the next couple of weeks.

Equipment: Lower inbound volumes have brought relief to equipment deficits and congestion for both inland and coastal ports.

TIPS:

• Book at least two weeks prior to the ready date.

• Coordinate with providers as soon as possible on post-CNY bookings.

• Expect blank sailings to carry on through Q1 2023.

IMPORT: Europe to North America (TAWB)

Rates: With capacity increasing and demand dropping, rates remain falling for this trade.

Space: Space to both U.S. coasts have opened up as U.S. congestion becomes minimal.

Capacity: Larger vessels have entered the market boosting the trade lane’s capacity. The 2M Alliance (Maersk and MSC) are announcing additions of even more market capacity.

Equipment: Availability has improved on both sides of the trade.

TIPS:

• Book at least three weeks prior to ready date.

• Even as market conditions become more fair, premium services (i.e., no-roll options and improved cargo reliability) should still be considered.

EXPORT: North America to Asia

Rates: Rates are stable if not slightly decreasing. They are not plummeting in this market like its inbound counterpart (Asia to North America).

Capacity: Capacity remains stable, but the market is not impregnatable to blank sailings.

Equipment: Most inland and coastal ports have balanced out their equipment availability. However, inland hubs Chicago and Kansas City remain outliers and are experiencing some issues.

TIPS:

• Book at least three weeks prior to the time of departure.

• While not as frequent as its inbound counterpart, remain in close contact with your providers to be aware of any potential developments, like blank sailings.

InterlogUSA Proudly Presents...Ep. 5: Discussing the China Trade Lane

In our latest episode, InterlogUSA’s Rachel and Madison discuss the China trade lane and what importers can expect after Chinese New Year.

If you are a China importer, you’ll want to check this episode out!

“Freight FM” features short-form video interviews with InterlogUSA’s industry experts offering insights into breaking news, market trends, our company’s history, and more!

Freight News

UP halts all container traffic through Los Angeles and the Midwest

As mentioned above in our market update section – all domestic and international containers – in both directions – between Southern California and the key inland hubs of Chicago and Kansas City have been halted, due to a bridge outage on its network in New Mexico.

A UP spokesperson said in a statement, “customers with rail shipments moving through the impacted area should anticipate a 72-hour delay.”

This “temporary suspension” went into effect early Tuesday and will last until further notice. Additionally, all shipments to and from Mexico through Nogales or El Paso are also affected by the suspension.

Recovery of Trans-Pacific Container Volumes

Cargo demand is continuing to be weak and is expected to continue into this year, because of high inventory levels and the possibility for a global recession.

Furthermore, recovery of Trans-Pacific container volumes will depend, in part, on how quickly importers are able to deplete excess inventories in the next few months – the JOC reports.

Additionally, four merchandising sectors that are worth keeping an eye on are furniture and furnishings, household appliances and electrical/electronic goods, hardware/plumbing/heating equipment and supplies, and apparel.

As sources point out, these manufacturing sectors purchase product groups where imports are prevalent, as well as their large size.

Watch Our January Webinar!

We discussed the impact of zero COVID policy suspension in mainland China before the Chinese New Year holiday, CNY impacts, carriers’ blank sailings before/after CNY timeframe, and the 2023 China Ocean Market Outlook.

Sign Up for Next Month's Webinar

Our next webinar will be on Wednesday, February 15th!

Keep an eye out for an announcement on topics we’ll be discussing next webinar and potential special guests!

We would like to hear from you. If you have any questions or topics you would like our experts to discuss in future webinars, please let us know!

Interlog  Insights

Insights

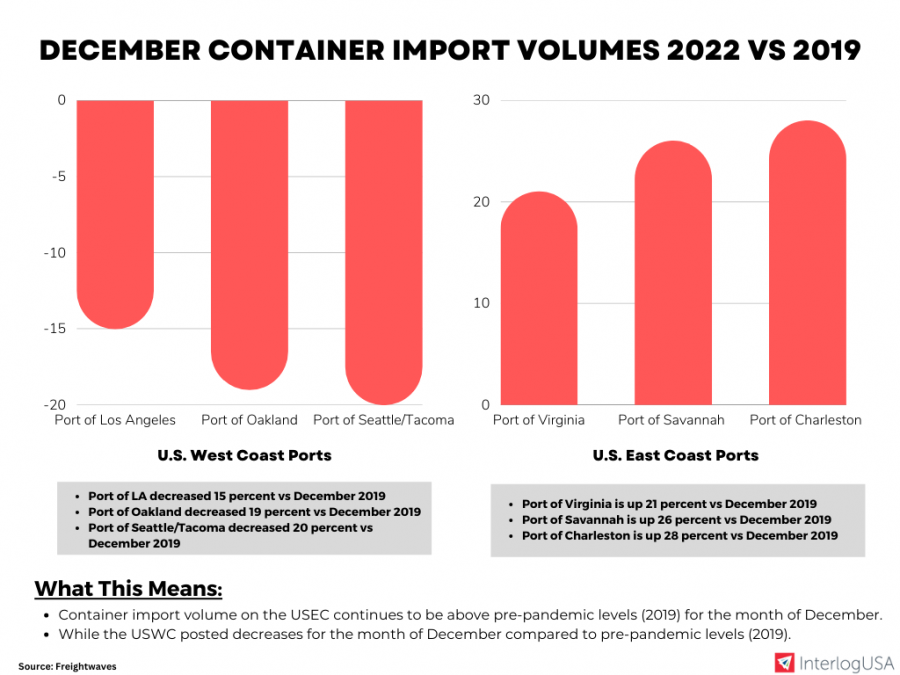

In last week’s newsletter, our experts discussed predictions surrounding Chinese New Year, air freight’s quiet Chinese New Year, and container flow post-pandemic at U.S. ports.

We are approaching our final week in this month’s Interlog Insights, so don’t forget to sign up so you can receive upcoming insights throughout this year!

Sign up for our

industry answers

Our team works to provide valuable, unique, and relevant content to assist you in finding solutions. Sign up now.