UPDATE: Red Sea hostility leads to Suez Canal uncertainty

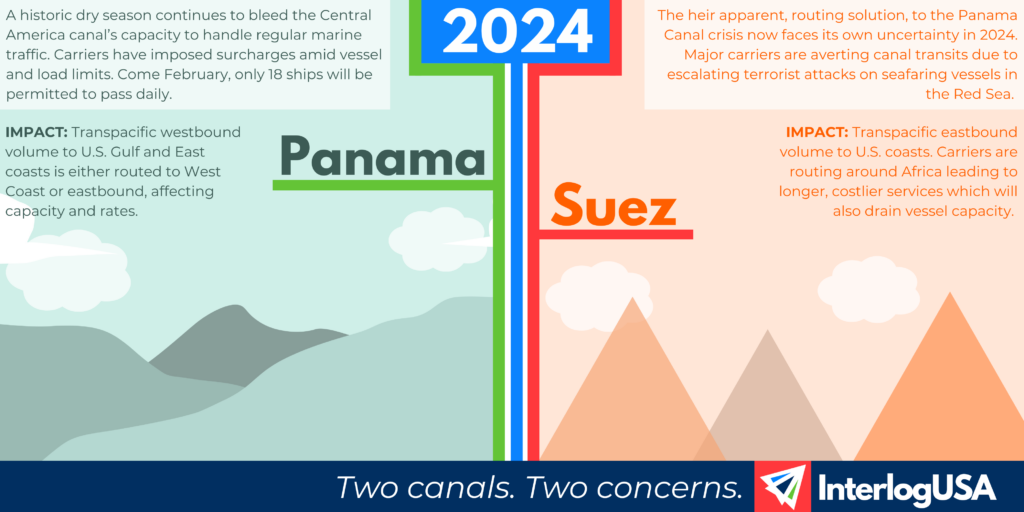

Just as the Suez captured the intrigue from stakeholders as a competitive alternative to its drought-struck contemporary, the canal now faces its own crisis of sorts. The Houthis, Yemen rebel militants, have been attacking cargo ships transiting through the Red Sea—the body of water south of the Suez.

While the militant group states that its targeting vessels with links to Israel, attacks on non-Israel fleet, like Hong Kong-based carrier OOCL, have proven otherwise. The number of ocean carriers refusing to risk Red Sea transits is growing by the day.

The world’s largest carriers Maersk, MSC, Hapag-Lloyd, CMA CGM, Evergreen, Yang Ming, Cosco, OOCL, HMM, and ONE have paused Red Sea transits opting to reroute around Africa’s Cape of Good Hope. The change in routing adds considerable transit time.

Longer voyages will require additional vessel capacity from carriers if they intend on maintaining their typical weekly services from Asia to Europe and the U.S. This will likely lead to an initial capacity crunch and an increase in container shipping rates.

Oil and gas companies, tankers, and car carriers are also rerouting away from the canal.

For more analysis on the Suez Canal, Red Sea attacks, and the impacts on U.S. shippers, sign-up for Interlog Insights.

IMPORT: Asia to North America (TPEB)

Recent Developments:

- Major carriers have announced general rate increases (GRIs) on North American imports from India beginning in January.

Rates: Rates remain level, however they could rise in the coming weeks as longer transits (from canal uncertainty) leads to increased shipping demand measured in ton-miles (volume multiplied by distance).

Space: Space is generally open, but certain services have seen tightening.

Capacity: Longer transits averting the canals will absorb vessel capacity in order to maintain weekly services.

Equipment: There are no outstanding equipment deficits or bottlenecks.

TIPS:

- Hold your logistics partners accountable for frequent updates regarding current market conditions and routing impacts.

- Establish a firm timeline for future import activity.

IMPORT: Europe to North America (TAWB)

Recent Developments:

- Carbon-related surcharges have been announced by ocean carriers ahead of the shipping industry’s indoctrination to the EU emissions trading system in January. For more information.

Rates: Rates have receded to lower levels after an abrupt increase late last month.

Space: Space is open.

Capacity: Capacity remains plentiful. No major adjustments from carriers, yet.

Equipment: Availability on both origin and destination sides, unless advised otherwise.

TIPS:

- Book at least three weeks prior to the ready date.

- Carriers have yet to take aggressive action, like they have in the Pacific, regarding capacity management. However, this trade is not profitable for them in its current state, so be on the lookout as they may become more emboldened.

EXPORT: North America to Asia

Recent Developments:

- The U.S. is on pace to be the world’s largest producer and exporter of natural gas this year.

Rates: After sliding through October, outbound rates have levelled off—remaining relatively low.

Capacity: Schedule reliability can be fickle in pockets.

Equipment: Rail car availability issues have softened.

TIPS:

- Insufficient communication with sailing schedules can lead to higher detention and demurrage fees as well as higher trucking and storage costs. Ensure your logistics partners are not keeping you and your cargo in the dark.