Competitive Edge

July 24th, 2024

Stay Current with InterlogUSA

Latest Industry Happenings and Market Updates:

Across International Shipping: News and Developments

Port Update: Last week’s global technology outage did not cause any disruptions or closures at U.S. seaports, according to port officials who spoke to FreightWaves.

On the other hand, the outage— caused by a defect in a Crowdstrike content update for Windows—posed major issues for the airline industry. According to FlightAware, as of Monday, instances of flight delays and cancellations remained high as nearly 28,000 were delayed, while 1,600 were cancelled.

Labor: Import data from Q2 compiled by the Journal of Commerce indicates that labor uncertainty and extended (costlier) voyages have led to an increase in cargo diversions from the East and Gulf coasts to the West Coast. The Q2 timeframe also supports a popular strategy of bringing in cargo earlier in the year to avoid these issues if they enflame in the fall.

International Longshoremen’s Association (ILA) leadership has stated that it will not seek to extend contract negotiations past their Sep. 30 deadline nor seek assistance from federal mediators to broker a deal. ILA represents unionized dockworkers at U.S. East and Gulf coast ports and is currently in negotiations for a new coastwide contract with maritime employers. If no agreement is reached by Sep. 30, the union has vowed to engage in a coastwide strike Oct. 1.

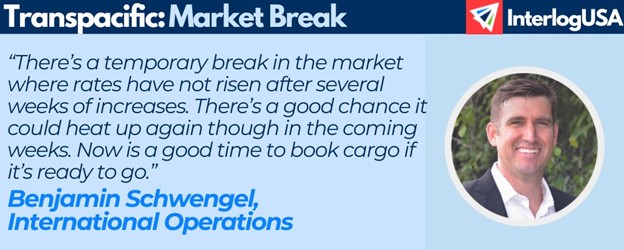

IMPORT: Asia to North America (Transpacific Eastbound)

Rates: Aside from India origins, inbound rates to all U.S. coasts have leveled this past week following several weeks of increases.

Cargo ready to move? Contact us today!

Space: Space is tight on most services. In some cases, carriers have not offered the entirety of space previously awarded within their contracts with shippers and NVOs.

Capacity: Carriers have introduced more vessels into the trade, injecting more capacity to accommodate rising demand.

Congestion: A few Asian origins are reporting congestion and extended wait times. While Singapore has become the most publicized example, certain Chinese ports, like Ningbo, are also working through backlogs.

TIPS:

- Now until at least the end of July is an ideal time to book ready cargo as rates will not increase before August. It is also uncertain how transportation costs will develop next month, lending there more reason to act as soon as possible if there’s ready cargo.

- Hold your logistics partners accountable for frequent updates regarding current market conditions, mainly continued instances of rate increases.

- Strongly consider booking shipments farther in advance as demand strengthens and space tightens.

IMPORT: Europe to North America (Transatlantic Westbound)

Rates: Since spring, rates have stayed level on this trade, a reassuring sign of balance in the market.

Space: Space is open.

Capacity: Reassuring demand from U.S. importers has prompted better utilization of available capacity.

TIPS:

- Book at least three weeks prior to the ready date.

- Keep an eye on East Coast labor uncertainty as a coastwide strike could occur as early as October if no contract is settled between dockworkers and maritime employers.

EXPORT: North America to Asia

Rates: Outbound rates from the West Coast have risen slightly after a freefall earlier this summer. Meanwhile, rates from the East Coast have decreased slightly. Conditions at West Coast ports are comparatively more volatile than conditions at East Coast ones.

Capacity: As seen during the pandemic, export service is vulnerable in periods when carriers set their focus on a more favorable import market, as prioritizing inbound business is more profitable. As peak import season holds steady, exporters should be cautious of how this can impact their cargo.

TIPS:

- Insufficient communication with sailing schedules can lead to higher detention and demurrage fees as well as higher trucking and storage costs. Ensure your logistics partners are not keeping you and your cargo in the dark

Freight News

Port of Houston Receives USDA Approval for Cold-Treated Produce Shipments

Suez Canal Revenue Plunges $2 Billion Amid Red Sea Challenges

The Port recently received approval to handle cold-treated produce shipments, which they say could allow the port to receive more of the area’s refrigerated goods business.

Under the USDA’s Animal and Plant Health Inspection Service (APHIS) regulations, fresh produce imports can expedite entry into the U.S. without additional inspection provided the cargo has been consistently maintained at a specified temperature during transit to eradicate pests.

This approval allows the port to provide more services to their customers, especially those in the refrigerated goods sector. This approval allows the port to provide more services to their customers, especially those in the refrigerated goods sector. Other major U.S. ports that have this APHIS authorization include New York-New Jersey, Savannah, and Philadelphia.

In Fiscal Year 2023/2024, the Suez Canal saw its revenue drop to $7.2 billion, down 23% from the previous year’s $9.4 billion, per Maritime-Executive. Total tonnage passing through the canal declined by one-third, and the number of transits fell by around 22% year-over-year.

The long diversion around Africa has absorbed most excess tonnage on the market, driving spot rates back up. The schedule changes from this detour create “bunching” at key transshipment ports, leading to port congestion as far away as Singapore. Vessel deployments have also been shuffled and reorganized on trade lanes around the globe in order to free up more tonnage for the Cape of Good Hope route, and this will have a knock-on effect in seemingly unconnected markets.

Webinar: Market Updates, Current Events

In last week’s webinar our team discussed:

— transpacific (west coast) and transatlantic (east coast) market conditions and updates

— any updates regarding the Panama Canal/Suez Canal?

Plus, recent current events in the industry:

— U.S. East/Gulf Coast Labor Negotiations

— Rough Weather in South Africa Impacts Vessels

— Canada Rail Union TCRC and CN/CPKC Bargaining Update

Which Geographical Strait Cuts Between Africa and Europe?

Answer: D – Strait of Gibraltar

Johnny Cargo sure knows a lot! Other than fun facts, Johnny also can provide insight into InterlogUSA’s many service and pricing options. He is always available for a quick conversation. CLICK HERE to chat with Johnny Cargo.

Sign up for our

industry answers

Our team works to provide valuable, unique, and relevant content to assist you in finding solutions. Sign up now.