Competitive Edge

June 26th, 2024

Stay Current with InterlogUSA

Latest Industry Happenings and Market Updates:

IMPORT: Asia to North America (TPEB)

Rates: Another round of rate increases (GRIs) is widely expected to hit the trade on July 1. While the amount of these surcharges is still to be determined, there is a chance that container rates to the East Coast could surpass $10,000.

Space: Space continues to squeeze. In some cases, carriers have not allotted the entirety of space granted within their contracts with shippers and NVOs.

Question or concerns on how this market change will affect your upcoming shipments? Get in touch with us today!

Capacity: Stronger demand and longer voyages around southern Africa (due to geopolitical uncertainty in the Red Sea) have filled available capacity.

Congestion: A few Asian origins are reporting congestion and extended wait times. While Singapore has become the most publicized example, certain Chinese ports, like Ningbo, are also working through backlogs.

TIPS:

- Do not “wait it out”. Market conditions are not likely to soften anytime soon as peak shipping season is underway.

- Hold your logistics partners accountable for frequent updates regarding current market conditions, mainly continued instances of rate increases.

- Strongly consider booking shipments farther in advance as demand strengthens and space tightens.

IMPORT: Europe to North America (TAWB)

Labor: Earlier this month, the International Longshoremen’s Association (ILA), representing unionized dockworkers at U.S. East and Gulf coast ports, indefinitely suspended negotiations for a coastwide contract with maritime employers.

Rates: Rates have levelled off, considerably higher than they were in March, but significantly lower than they were following an upward jolt in April.

Space: Space is open.

Capacity: Reassuring demand from U.S. importers has prompted better utilization of available capacity.

TIPS:

- Book at least three weeks prior to the ready date.

- Keep an eye on East Coast labor uncertainty as a coastwide strike could occur as early as October if no contract is settled between dockworkers and maritime employers.

EXPORT: North America to Asia

Rates: Rates are level after taking an upward climb in May.

Capacity: Generally speaking, capacity is available, but U.S. export movement can be influenced, even hindered, when more attention is placed on the import market.

TIPS:

- Insufficient communication with sailing schedules can lead to higher detention and demurrage fees as well as higher trucking and storage costs. Ensure your logistics partners are not keeping you and your cargo in the dark.

Freight News

Reefer Shippers Grapple with Longer Booking Times, Box Shortages

Cold chain shippers have faced extended booking lead times and logistical hurdles akin to dry cargo issues, the Journal of Commerce reports. Challenges are particularly acute for Asian exports, while Brazil deals with equipment shortages, congestion, and port developments impacting refrigerated imports and exports.

You don’t want refrigerated good to have delays, since they are perishable and can diminish the overall quality/profitability. However, despite these challenges, insurers note that there has been no significant uptick in claims for spoiled cold chain or perishable goods.

Do you ship refrigerated goods? If so, what do you think? Have you been seeing longer booking times/box shortages?

Carriers Temporarily Pause Bookings from India to U.S.

Finding available space aboard vessels bound from India to U.S. has become futile as major carriers have temporarily paused bookings for upcoming sailings.

Through most of July, open market bookings for most services between the two countries have already been filled. Next to demand, schedule disruptions due to Red Sea diversions and congestion across Asian ports have exacerbated capacity on the trade lane.

The second half of July is expected to be the earliest opportunity for securing space on services from India to U.S. coasts.

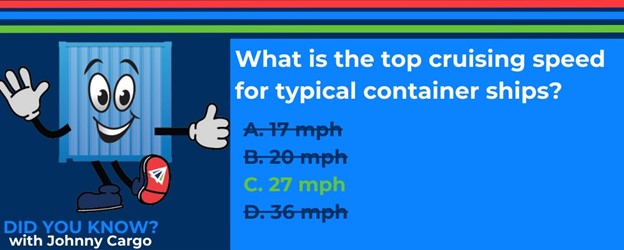

Did You Know? With Johnny Cargo!

Johnny Cargo sure knows a lot! Other than fun facts, Johnny also can provide insights into InterlogUSA’s many service and pricing options. He is always available for a quick conversation. CLICK HERE to chat with Johnny Cargo.

(Answer: C)

NEW: Watch Our Webinar, Special Guest

NEW: FreightFM Episode Ep. 14

Curious how to use data analytics to your advantage? In this webinar we discuss all things data and how they can be used to elevate your transportation. We were joined by a special guest, Antonio Gomez, to discuss this and more in our May 22nd webinar. Take a listen!

Why are produce shipments handled differently? Why do rates/capacity change during seasonal shipping periods? How does this impact non-produce shippers? All those questions and more answered in this episode.

Interlog  Insights

Insights

In last week’s June Insights, we discussed East, Gulf Coast talks being suspended by union. Plus, B.C. Longshore Foreman Union Rejects BCMEA Proposed Offer.

Make sure you sign-up (it’s free), to view our insights in real time every Friday at 10am CST.

Sign up for our

industry answers

Our team works to provide valuable, unique, and relevant content to assist you in finding solutions. Sign up now.