Competitive Edge

October 9th, 2024

Stay Current with InterlogUSA

Latest Industry Happenings and Market Updates:

Across International Shipping: News and Developments

[Weather] Hurricane Milton: Hurricane Milton, a category four storm as of Wednesday morning, is forecasted to hit Florida’s central Gulf coast late Wednesday.

Since Tuesday, several Florida ports have closed ahead of the storm’s impacts, including all ports in Tampa and St. Petersburg. The Port of Jacksonville closed its main gates to inbound cargo at 10 a.m. Wednesday and aims to reopen Friday morning barring significant damages.

Due to congestion from civilian evacuations and the likelihood of road closures after the hurricane, inland freight movement in the region will be challenged in the coming weeks.

InterlogUSA will continue to provide updates to clients impacted by Hurricane Milton’s anticipated disruptions to transportation facilities and networks.

[Labor] U.S. Longshore Strike Ends: On Thursday, unionized dockworkers resumed work at U.S. East and Gulf coast ports following agreements on wages and an extension to the current master contract until January 2025. The ILA union and USMX (maritime employers) jointly announced that the strike will cease as the two sides eye a return to the bargaining table.

[Labor] Port of Montreal Dispute: Montreal-based CityNews reported that unionized dockworkers at the Port of Montreal will refuse overtime beginning Oct. 10 for an undetermined amount of time. The action is another pressure tactic being used during negotiations for a new contract.

Since 2023, organized labor and maritime employers at the Canadian port have been at an impasse over a labor agreement which would cover some 1,200 dockworkers at Montreal.

Last week, a three-day worker strike targeted two of the Port of Montreal’s five container terminals. Scheduling and work balance are the main issues in dispute.

IMPORT: Asia to North America (Transpacific Eastbound)

Rates: Certain ocean carriers have withdrawn from their plans of implementing surcharges related to last week’s strike as the work stoppage has since ended.

Congestion: Mild backlogs may pose delays in USEC/GC cargo handling, but port officials have noted spare capacity across their networks is alleviating the situation.

Space: Discretionary volumes are returning to the USEC/GC.

Capacity: Capacity has fatigued over the last several months as routings around Africa sustain.

TIPS:

- As the year reaches its end, Q4 can be the right time to get a head start on your 2025 transportation and logistics strategies. While business needs can vary, in most cases, a discussion and evaluation of service providers (carriers, forwarders, Customs brokers, etc.,) should be top of mind, especially as it relates to any potential shortcomings in existing providers throughout 2024.

IMPORT: Europe to North America (Transatlantic Westbound)

Rates: Aside from a traditional round of peak season surcharges (PSSs), rates have generally shown little change since August.

Capacity: Coupled with last week’s three-day U.S. longshore strike, port congestion at several Europe ports has reduced available capacity.

EXPORT: North America to Asia

Harvest Season: The peak season for U.S. agriculture exports is underway. Outbound rail and barge volumes to U.S. ports surge.

Rates: Rates are healthy given seasonal demand from agriculture exports.

Space: Exporters can return to moving outbound loads via East Coast railroads or river barges to the Gulf Coast as the strike has ended.

Freight News

LA and Long Beach Ports Make Strides in Emission Reduction Despite Challenges

IATA’s August Air Cargo Market Report Highlights Strong Demand

The ports of Los Angeles and Long Beach significantly reduced emissions in 2023 due to fewer vessel arrivals and the use of cleaner cargo-handling equipment from rail to drayage. Their emissions dropped by 91% for diesel particulate matter, 72% for nitrogen oxides, 98% for sulfur oxides, and 20% for greenhouse gases since 2005 – the Journal of Commerce reports.

However, stakeholders face additional regulatory challenges that could raise operating costs and potentially limit cargo volume. Those mandates, include independent source rules (ISRs) which can affect ports, railroads, and warehouse operators throughout Southern California, will significantly increase operating costs for the largest port complex in the U.S. In a letter to local mayors, industry representatives advocated for a more efficient approach to support zero-emission infrastructure instead of overly restrictive independent source rules.

The International Air Transport Association (IATA) has released its August 2024 data for global air cargo markets, revealing continued strong growth in demand. Although air cargo demand stayed robust, global economic indicators were mixed, as manufacturing output and new export orders began to show signs of decline.

Total demand, measured in cargo tonne-kilometers (CTKs), increased by 11.4% compared to August 2023 (with international operations seeing a 12.4% rise), per the IATA. This marks the ninth consecutive month of double-digit year-on-year growth.

Capacity, measured in available cargo tonne-kilometers (ACTKs), rose by 6.2% year-on-year (8.2% for international operations), per IATA. This growth is largely driven by a 10.9% increase in international belly capacity, fueled by robust passenger market performance.

Which country was the world's leading coffee exporter in 2023?

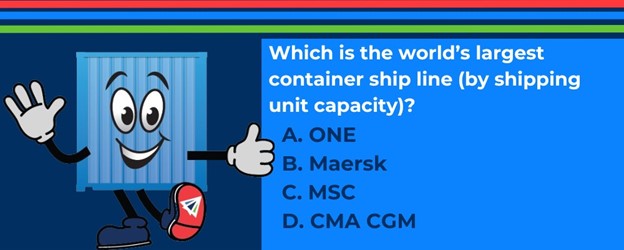

InterlogUSA’s chat bot Johnny Cargo sure is an inquisitive soul. However, he doesn’t just ask about industry-related trivia. Johnny also loves to ask supply chain professionals about their shipping arrangements and which areas can benefit from InterlogUSA’s assistance as an end-to-end freight forwarder.

He works around the clock and is always available for conversation.

Sign up for our

industry answers

Our team works to provide valuable, unique, and relevant content to assist you in finding solutions. Sign up now.